什么是伯格·沃纳菲尔特

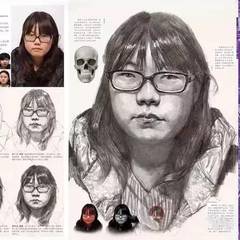

伯格·沃纳菲尔特(Birger Wernerfelt)是哥本哈根大学的哲学学士、经济学硕士,哈佛大学的工商管理博士。曾任A/S CREOLE的副总裁,后到哥本哈根大学、美国密歇根大学、美国西北大学任教。现就职麻省理工学院斯隆管理学院管理科学教授,博士委员会成员。

沃纳菲尔特发表管理、经济论文无数。其中,1984年在“企业资源基础理论”中,提出企业是一个资源集合体,企业拥有或者控制的资源影响着企业的竞争优势和收益水平,企业成长战略的实质就是在现有资源运用和新资源培育之间寻求平衡。该文的发表,标志着企业核心竞争力理论的兴起。

Birger Wernerfelt is an economist and management theorist. He is the JC Penney Professor of Management and head of the PhD Program at the MIT Sloan School of Management.

A Danish citizen, Wernerfelt has degrees from the University of Copenhagen and Harvard. Prior to coming to MIT in 1989, he was employed by the University of Copenhagen, the University of Michigan and Northwestern University. He is married to Harvard Professor Cynthia Montgomery.

伯格·沃纳菲尔特的贡献

Wernerfelt is best known for “A Resource-based View of the Firm” (1984), which is one of the most cited papers in the social sciences. based on the premise that firms are heterogeneous, the article characterizes sustainable differences (resources), suggests that optimal competitive strategies are based on these resources, and describes how current resources can be used to develop new ones.

In the last several years, he has been working on implications and foundations of the “Adjustment-cost Theory of the Firm” (1997). The theory portrays the employment relationship as an attempt to exploit economies of scale in bargaining costs: The employer and the employee share the benefits of negotiating a single average price (wage) for a sequence of transactions instead of individual prices for each of them. The wedge in costs allows the parties to sustain an implicit contract with at-will options to fire and quit. The original article proposes that the scope of the firm be defined by the employment relationship.

In later works, Wernerfelt has developed the theory to show that the employer should own most of the productive assets, that incentives are weaker inside firms, and that more information is communicated within than between firms.

伯格·沃纳菲尔特的学术选读

“A Resource-based View of the Firm”, Strategic Management Journal 5, no. 2, April-June, pp. 171-80, 1984.

“Tobin’s q and the importance of Focus in Firm Performance”, (with Cynthia A. Montgomery), American Economic Review, 78, no. 1, March, pp. 246-50, 1988

“Diversification, Ricardian Rents, and Tobin’s q”, (with Cynthia A. Montgomery), RAND Journal of Economics, 19, no. 4, Winter, pp. 623-32, 1988

“Umbrella Branding as a Signal of New Product Quality: An Example of Signalling by Posting a Bond”, RAND Journal of Economics, 19, no. 3, Autumn, pp. 458-66, 1988

“General Equilibrium with Real Time Search in Labor and Product Markets”, Journal of Political Economy, 96, no. 3, August, pp. 821-31, 1988

“On the Nature and Scope of the Firm: An Adjustment-Cost Theory”, Journal of Business, 70, no. 4, October, pp. 489-514, 1997

“Why Should the Boss Own the Assets?”, Journal of Economics and Management Strategy, 11, no. 3, Fall, pp. 473-85, 2002

“Determinants of Asset Ownership: A Study of the Carpentry Trade” (with Duncan I. Simester), Review of Economics and Statistics, 87, no. 1, February, pp. 50-58, 2005

猜你喜欢内容

-

什么是风险性决策

在财经领域,风险性决策是一种常见但又充满挑战的决策方式。风险性决策指的是在决策过程中,存在多种可...

-

商业险需要什么手续

在如今的社会经济环境中,商业险作为一种重要的风险保障手段,受到了越来越多人的关注。然而,办理商业...

-

没指标是什么意思

例如,在股票投资中,可能指没有特定的技术分析指标来辅助判断股票的走势;在基金投资中,可能意味着没...

-

什么是时点存款

在金融世界中,时点存款是一个具有特定含义和特点的概念。时点存款,简单来说,是指在某个特定时间点上...

-

南方现金通e的特点是什么

南方现金通 e 作为一款在基金市场上备受关注的产品,具有一系列显著的特点,这些特点在理财规划中展现出...

-

什么是产品的品种

在财经领域中,产品的品种是一个重要的概念。简单来说,产品品种指的是具有特定特征和属性的一类产品。...

-

货币资金的管理方法有哪些

货币资金作为企业资产的重要组成部分,其管理的有效性直接影响着企业的运营和发展。合理的货币资金管理...

-

几内亚的货币是什么

几内亚共和国,位于西非西岸,是一个资源丰富但经济发展面临诸多挑战的国家。其法定货币是几内亚法郎。...

-

应收据的定义是什么

在财务管理领域,应收据是一种常见且重要的金融工具。应收据,简单来说,是由付款人或受票人签发,由收...

-

L型经济压力线的含义是什么

在经济领域中,“L 型经济压力线”是一个备受关注的概念。简单来说,L 型经济压力线描述的是经济增长在...